COVID-19 has spread across the world, leading to unprecedented lockdowns and an unpredictable business environment for companies everywhere. This paper provides an analysis of FTSE 100 COVID-19 financial reporting between the start of 2020 and 3 April and highlights the uncertainty facing UK-listed companies and the investment community as we move into uncharted waters.

Unscheduled reporting highlights rising uncertainty.

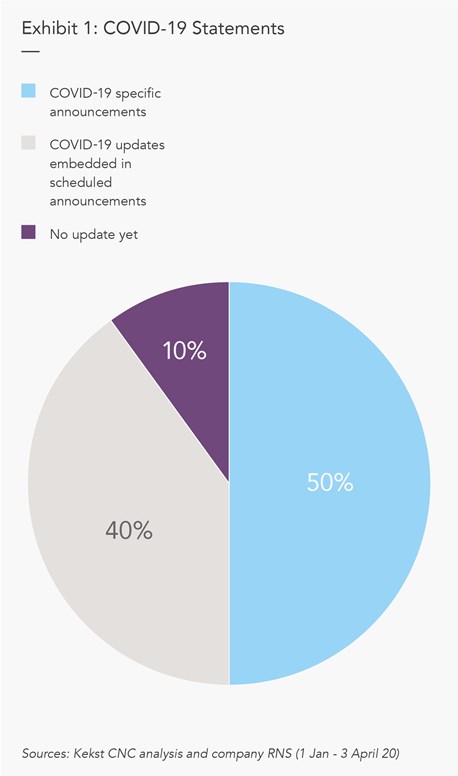

50 FTSE 100 companies have interrupted their regular reporting schedules to release market announcements relating to the virus’s impact on their operations. Unsurprisingly, those reporting operate in some of the most affected industries – Travel & Leisure, Home Builders, and General Retailers.

40% of FTSE 100 companies have used scheduled announcements to update on COVID-19. September and December year-end companies, with operations or a strong presence in China, were amongst the first to flag the heightened uncertainty and the likely impact on the business in February.

The remainder of the FTSE 100 have not yet released market announcements relating to or updating the market on COVID19’s impact. In particular, those companies expected to experience a materially positive impact, or in some cases a limited impact, have seemingly opted to wait until there is greater visibility.

For all those reporting, scheduled or unscheduled, management teams have sought to appease market nervousness, underlining the strength of their long-term strategy, solid liquidity position, robust nature of their operating models and ability to quickly adapt and deploy resources and investment where necessary.

To guide or not to guide?

Almost 40% of FTSE 100 companies have been so materially impacted that they have decided to downgrade existing guidance or withdraw it entirely. Of those retaining some form of guidance, half have provided explicit, numerical updates of the expected financial impact on future results, whilst the remainder has provided only qualitative guidance.

One third of FTSE 100 companies have maintained their current outlook or guidance but have flagged that the evolving macroeconomic impact of COVID-19 may have a negative impact on future operations.

But there are some businesses that may benefit from consumers spending more time at home or working remotely. Two companies, in particular, a Food Retailer and a Telecommunications company, have formally reported an increase in demand. While this is to be expected given the wave of stockpiling and increased data consumption as the country is in lockdown, these companies have stopped short of providing upgrades as they prudently flag the positive trends they have seen in the early months of 2020 may reverse or normalise later in the year.

Putting people first.

Companies across the UK have taken quick action to protect customers and employees. Ways of working have transformed and protective measures have been put in place to slow the spread of the virus and adhere to government guidelines around social distancing and non-essential travel. This is also true for FTSE 100 companies who have generally (either through customer or market communications) reiterated their commitment to the safety and wellbeing of their customers and people. However, for some, the disruptive impact of COVID-19 has meant they have had to make difficult decisions.

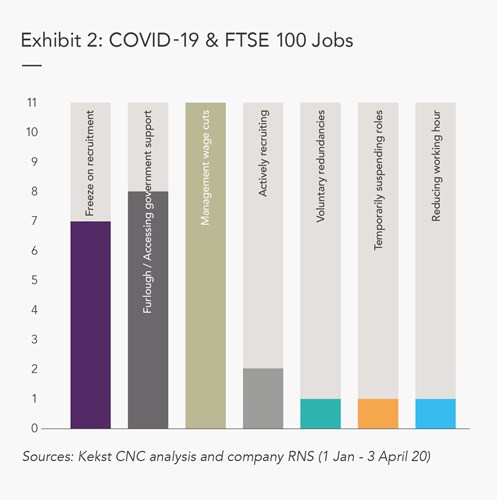

FTSE 100 companies reporting explicitly on the matter have been hesitant to highlight any job cuts as a result of COVID-19 and have instead made commitments to recruitment freezes, management wage cuts and working alongside the UK and other governments who are providing furlough assistance. Exhibit 2 tallies the most frequently cited measures being taken by the FTSE 100 as of 3 April 2020.

FTSE 100 Food Retailers have been the only sector to highlight significant job increases as they battle to keep shelves stocked and deliveries going.

Prudence may pay dividends in the future.

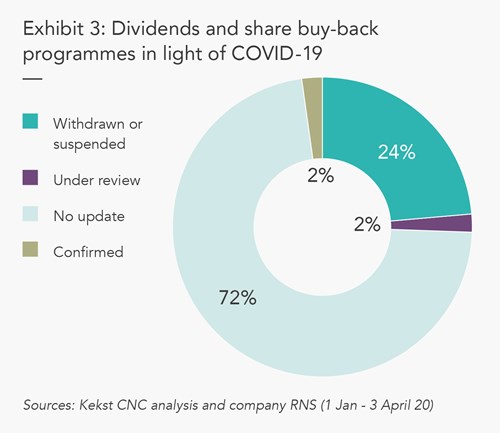

As of 3 April, 24 FTSE 100 companies had announced the withdrawal of dividends or suspension of their current or future share buy-back programmes. Of these, the Banks were the largest single sector to ‘uniformly’ withdraw dividends, following the Prudential Regulation Authority’s (PRA) guidance to companies on 31 March.

Banks aside, the other 19 companies, many of which had already reported a deteriorating outlook, took the difficult decision to conserve cash and cut or withdraw dividends that had already been promised. Each company underlined the desire to be prudent and protect the long-term future of the business. A further two companies have released statements saying that their dividend is currently under review.

Two companies made the bold step to confirm the dividend. For one of these this was to combat market speculation that in light of the PRA’s guidance to Banks it may also be forced to cut its dividend. For the second, in its COVID-19 statement is reassured that operations were not materially impacted and thus the Board felt confident confirming their intention to pay a full year dividend despite increased uncertainty

Watch this space.

As with all areas of stakeholder engagement, financial communications has had to adapt to address the unprecedented uncertainty and disruption of COVID-19. No sector has been immune or geography untouched. In the UK, companies have been proactive and guided as much as prudentially possible. Messaging has been centred on the well-being of people, communities and working to restore stability.

The situation remains dynamic and the comings days and weeks will bring new approaches and challenges for companies who have either delayed or are yet to release their full-year announcements. For those yet to report, the lessons learned from across the world and FTSE 100 companies that have already reported are as follows:

- Qualitative guidance on the impact, together with evidence of control and real leadership, should be seen as a minimum.

- Only communicate what you know to be the case. Stick to the facts but communicate regularly.

- Financial prudence, conservation of cash, and details on the balance sheet is a must.

- Understand that in these unprecedented times, stakeholders want to know about the social steps you are taking – emphasise the ‘S’ in ESG as much as financial and operational metrics. Tone is important here.

- Where possible, help investors understand the impact that certain government initiatives (furloughing for example) will have on the business.

- Highlight your strengths and the robustness of your operational model to respond to the unexpected.

- Reiterate the long-term strategy and goals. The pandemic does not invalidate what has been done and what you hope to achieve in a post-COVID-19 world.