The global economic outlook has “darkened significantly” in recent months according to comments made by Kristalina Georgieva, Managing Director of the IMF. Businesses across the globe have been hit hard by geopolitical turmoil and, as the wheels of the economy are grinding to a halt, the world now faces an increasing risk of recession in the next 12 months.

In this environment, businesses are triple-checking their expansion ambitions and reassessing their commercial strategies. Globally, this means fewer transactions – and more scrutiny on all sides of the deal. The way forward seems through meticulous planning, adaptability, and transparent communications to tame the impact of market forces and reassure stakeholders.

Stifled deal flow

Unsurprisingly, a concurrent drop in dealmaking activity has swept across the globe. In the second quarter of 2022, mergers and acquisitions (M&A) saw a year on year drop of 25.5%, and the value of announced deals dropped to $1 trillion, according to Dealogic data. Considering hiked interest rates, which central banks are scrambling to impose to combat inflation, acquisition financing has become too expensive for many companies. For companies with cash to spare, the rough markets have created too much uncertainty to agree on prices.

But pessimism is often transitory, and there are reasons to be optimistic: Although 2022 deal activity will likely fall short of a record-breaking 2021, it will likely still be one of the strongest markets witnessed over the past 20 years (Dealogic, 2022).

The attitude especially prevails across the Gulf Cooperation Council (GCC): IMF projections expect the economies of the GCC to expand by 5.9% overall in 2022. Notably, Saudi Arabia's economy is still projected to grow by 7.6% this year, helped by strong oil demand and wider economic growth.

GCC market nuances

While MENA – and especially GCC – economies have also been impacted by the global downturn in the form of rising interest rates, markets were significantly bolstered by appreciating oil prices and in the UAE resilient real estate activity.

Mergers and acquisitions across the MENA region remained steadfast as economic diversification initiated by governments continues to buoy interest in strategic transactions. Fiscal reforms, particularly in the UAE and Saudi Arabia, are increasing investors’ appetites, while government-led initiatives are supporting burgeoning start-up ecosystems that further increases deal activity. It seems that megatrends like digital disruption, future cities, renewable energy, digital health, and sustainable lifestyles have unlocked opportunities for the GCC to attract new investments.

According to the latest EY MENA M&A Insights report, the MENA region recorded 359 M&A deals worth $42.6 billion during the first six months of 2022. Some significant examples include, Saudi Arabia’s Public Investment Fund making a domestic acquisition by investing acquiring a 16.8% stake in Kingdom Holding Company for $1.5bn. Incoming activity by Canada’s Caisse de Depot et Placement du Quebec making a trifecta of investments in the UAE, respectively acquiring 22% stakes in Jebel Ali Free Zone, National Industries Park, and Jebel Ali Port. In addition to outbound deals, exemplified by Emirates Telecommunications Group Company acquiring a 9.8% stake in UK’s Vodafone Group – in a major deal worth $4.398 bn.

This increase in M&A activity represents a 12% rise from 2021.The report shows that over this period, domestic deals contributed 48% and 33% of the total M&A deal volume and value, respectively. Although fluctuating crude prices, economic uncertainty, and disruptions to global markets provided some momentum, deal activity was significantly driven by involvement of private equity or sovereign wealth funds. Regarding domestic PE or SWF deals, the UAE was the most favoured destination with 18 deals, while Saudi Arabia was the most active acquiring region with 27 deals.

Communicating to build trust

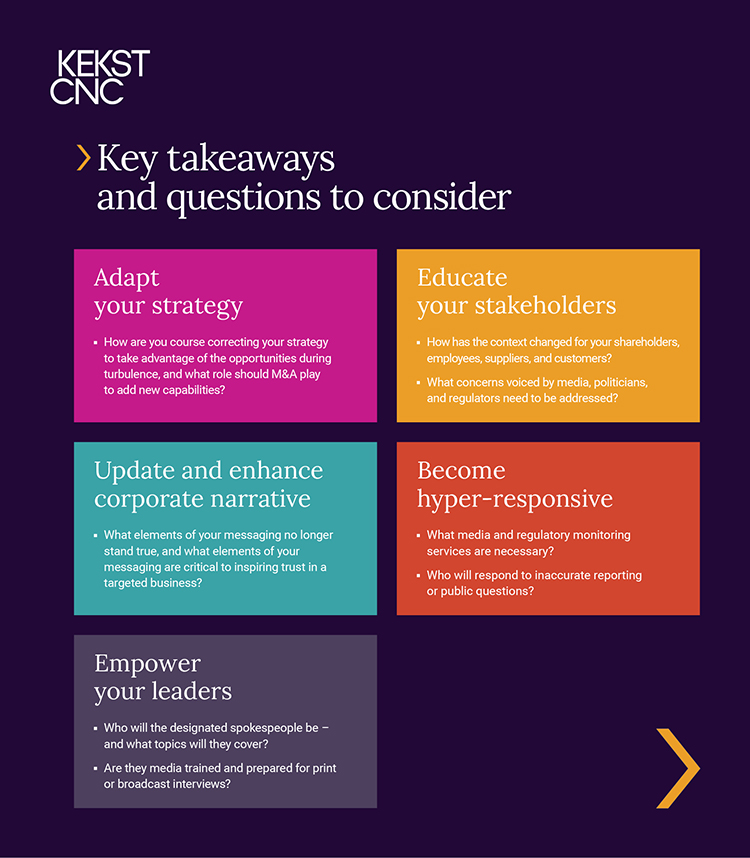

Structured and strategic communications by business and leadership play a critical role in mergers and acquisitions. They can decrease the impact of noise and distractions surrounding transactions and can mitigate potential reputational or financial damage. Distressed market conditions in a bear market amplify the importance of this due to low business and investor confidence. If businesses can cohesively communicate and address situations head on, this tends to inspire trust, restore confidence, and generate much-needed certainty.

A communications plan will be critical in laying a foundation for the combined organization’s future success. The eventualities and scenarios which may arise are countless, so meticulous planning is necessary to swiftly address questions or developing situations which draw media attention. The communications plan is one of the few workstreams during a merger which goes “live”, immediately acting as a powerful reference as soon as merger conversations begin.

Effective communications are not only critical for the success of the transaction, but also crucial for current and future brand visibility.