On July 8, Kekst CNC hosted a virtual ESG panel event to discuss the Impact of COVID-19 on ESG Priorities. We were joined by Rob Cameron, Global Head of Public Affairs at Nestlé and Tom Fekete, Head of Sustainable Investing for EMEA and Asia at BlackRock. We asked them to provide their reflections on the ESG findings from the Kekst CNC COVID-19 Tracker Edition 3 (15 June 2020) which summarised data from a representative sample of 6,000 people in six countries - the UK, US, Germany, Sweden, France and Japan about their environmental, social and governance (ESG) priorities.

James Johnson and Tom Lubbock, senior advisors of Kekst CNC’s research offering, summarized the key findings:

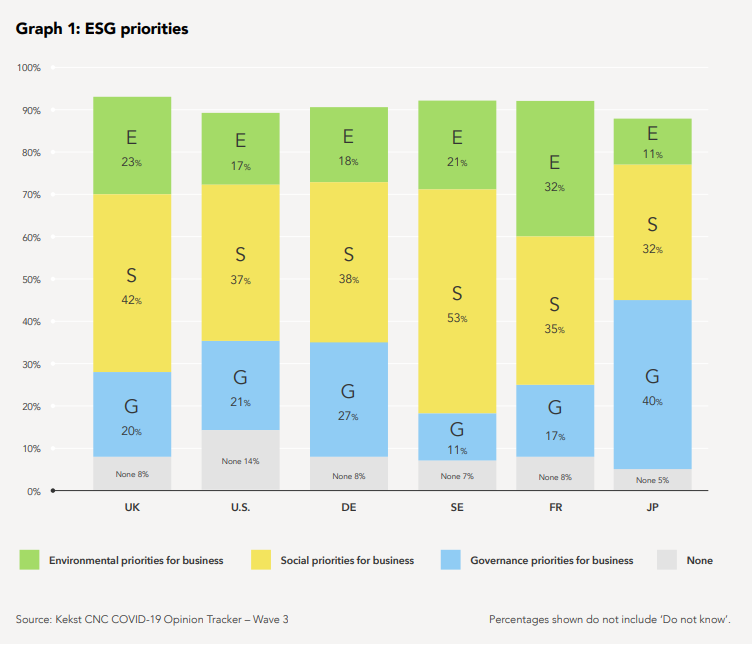

- In a poll conducted by Kekst CNC in June, consumers were asked to choose between environmental, social and governance issues. Whilst all of these topics are interconnected, we found that there has been a shift to the ‘S’ of ESG, with a significant proportion of those polled wanting to see businesses focusing on the measures to help society and people. This is particularly the case in Sweden (53 percent), UK (42 percent), Germany (38 percent) and US (37 percent).

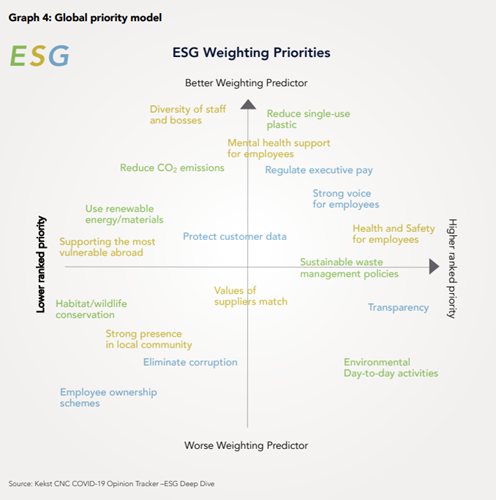

- When looking at ESG weighting predictors, we uncovered two interesting findings:

- A link between the COVID-19 crisis and the focus on social: People who are are most focused on social measures also say they are most concerned about their health as a result of the pandemic.

- Age cohorts do not behave linearly and have individual nuances: Millennials (born between 1981 and 1996) are moving toward social issues.

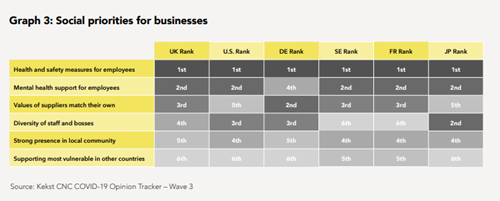

- When looking at social priorities for business, there was unanimity across the six countries regarding the top priority

- health and safety measures for employees.

- Our ESG Weighted Priorities analysis, three of the highest priority issues related to employee concerns: Health and Safety; mental health and diversity

Another key observation from a recent focus group, which Kekst CNC conducted for Times Radio in the UK, was that while the general public is familiar with the words environmental, social and governance, they do not necessarily associate those terms with the acronyms ESG. What did matter to the focus group was how businesses are handling these issues.

To summarize the panel’s key conclusions:

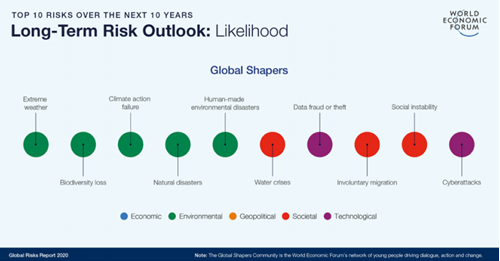

1. It’s clear that social issues have risen in the agenda, but environmental and social risks are interconnected

COVID-19 has tested stakeholder capitalism and in particular how companies treat their employees, suppliers and customers. The societal values that organizations’ leaders applied in the pandemic will be critical as the world faces environmental risks in the future, particularly the top five risks identified in the 2020 WEF Global Risks Report.

Tom Fekete confirmed that while ESG was historically dominated by the ‘E’, investors have been increasingly focused on social issues. Indeed, companies that greater operational resilience in the pandemic (as demonstrated by stronger client relationships, robust employee programs and supplier relationships and excellent health and safety) were ranked higher by investors and their stock price performed better. According to Tom, BlackRock has been “increasing the dialogue around employee management and all the questions around loyalty, fairness and mutual engagement in various relationships, be it with employees, suppliers or clients.”

Rob Cameron emphasized that the pandemic has refocused companies on the importance of people be they employees, suppliers or communities. Companies should concentrate on three key elements: the health, safety and security of their employees; continuity of the supply chain; and connecting with local communities. This effort, he noted, does not take place in a vacuum, that “E” and “S” are interconnected. If companies want to ensure positive social outcomes such as the health and safety of employees and citizens, then their starting point has to be a focus on climate and environmental issues.

Rob later mentioned the work of economist, Kate Raworth, who observed in Doughnut Economics (2012) that environmental and climate risks cannot be separated from societal risks. She proposed that social boundaries (such as jobs, education, food, access to water, health services and energy) be introduced into the planetary boundary model of Johan Rockstöm, the scientist recognized for his work on global sustainability issues. Most recently, Amsterdam has embraced the core principles as the foundation of its post COVID-19 economic recovery plan, taking a more holistic approach.

Another important topic was the interconnectedness of biodiversity and climate change and the important role of ecosystems and ecosystems services. Rob Cameron remarked: “We are not going to be able to address climate change without a radical approach to natural climate solutions and issues like forests, water conservation, natural habitat, peatlands and wetlands restoration. All of these things are going to be massively important in addressing climate.”

2. Partnerships and investments in innovation are critical in tackling the world’s most pressing issues

Tackling the world’s environmental and societal issues will require collaboration and partnerships between corporates, NGOs, academic institutions, industry associations and investors. Both speakers gave examples of this during the discussion including their organizations’ partnership with the Ellen MacArthur Foundation to support the acceleration towards the circular economy, which is based on designing out waste and pollution, keeping products and materials in use and regenerating natural systems. In October 2019, BlackRock announced its Global Partnership with the Ellen MacArthur Foundation when it launched its first circular economy fund. The fund aims to drive investments in businesses already contributing to, or benefiting from transition to the circular economy. In spite of the resurgence of disposable plastic during the pandemic and consumers’ dropping their guard on single-use plastics. In November 2019, Nestlé joined the New Plastics Economy as a core partner to help achieve a circular economy of plastics and is also a signatory of the New Plastics Economy Global Commitment, which unites more than 400 organisations behind a common vision and targets to address plastic waste and pollution at its source.

3. Further progress is required for measurement of “social” issues

Historically, it has been easier for companies to measure progress on environmental and governance topics. Measuring progress on social issues, however, has been challenging due to lack of reliable and tangible data. Tom Fekete confirmed that social issues are growing in importance and that BlackRock is expecting companies to report on “how they manage employees, their talent management practice in particular around inclusion and diversity, and finally how they manage suppliers relationships.” BlackRock uses unconventional data sources, which as Glassdoor to monitor employee satisfaction for example. In the Netherlands, asset owners such as insurance companies have collaborated to introduce social angles into their assets under management and use the OECD guidelines for Responsible Business Conduct and UN Guiding Principles on Business and Human Rights. BlackRock measures a company’s stakeholder engagement (internal and external) and believes that where the asset manager has good data, it can actually influence its stock selection.

As outlined in our blog Corporate Responsibility in a Post COVID-19 world, companies will be under increased scrutiny from all stakeholders – but in particular from investors - regarding ESG policies, actions and KPIs to demonstrate progress. While the realities of climate change remain unaltered, the COVID-19 pandemic has highlighted the importance of the social and human side of sustainability, with the ESG spotlight turning to how companies treat their employees, customers and suppliers.

Longer term, it has become clear that societies and economies will be impacted by climate and environmental issues, and the two cannot be seen in isolation.

To help corporates build a narrative around their sustainability and ESG initiatives and pave a pathway to their goals, companies should consider commissioning consumer surveys, focus groups and industry benchmarking to help them understand the views of their stakeholders and engage in constructive dialogue. Data and analysis insights will enable them to evolve their programs, manage their ESG risks and identify opportunities to create value.