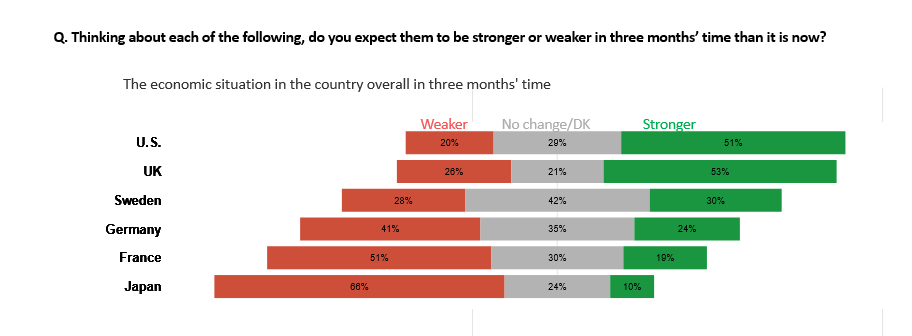

London, 12 May 2021 - British people are the most confident that the economy will be stronger in three months’ time than any other country surveyed, according to the latest wave of the Kekst CNC COVID-19 tracker, a survey of public attitudes in the United States, France, the United Kingdom, Sweden, Germany, and Japan.

More than half of the public (53%) believe that the UK’s economic position will be stronger in three months than it is today, the highest of any country surveyed, with half this level (26%) thinking it will be weaker. While a majority of people think that their own financial situation will be about the same as it is now, a quarter expect it to be better (26%). Very significantly the more positive view is most strongly held by the under-45s with 40% expecting their own economic situation to be better.

This positive picture compares to a bleaker portrait in France, where 51% expect their economy to be weaker in three months’ time, and only one in five expect it to be stronger.

Chart 1: Consumer confidence: Thinking about each of the following, do you expect them to be stronger or weaker in three months’ time than it is now?

Much of this is tied to the success of the vaccine rollout. Likely vaccine uptake remains at its highest in the UK with 90% of the public saying they have had the vaccine or will get it, the highest of all countries surveyed. This proportion is at the same level as in the February survey. British people are also the most likely to say that the pace of their vaccine rollout is “about right”, with eight in ten agreeing – compared to just one in five in Germany, fewer than one in four in France, and just one in ten in Japan.

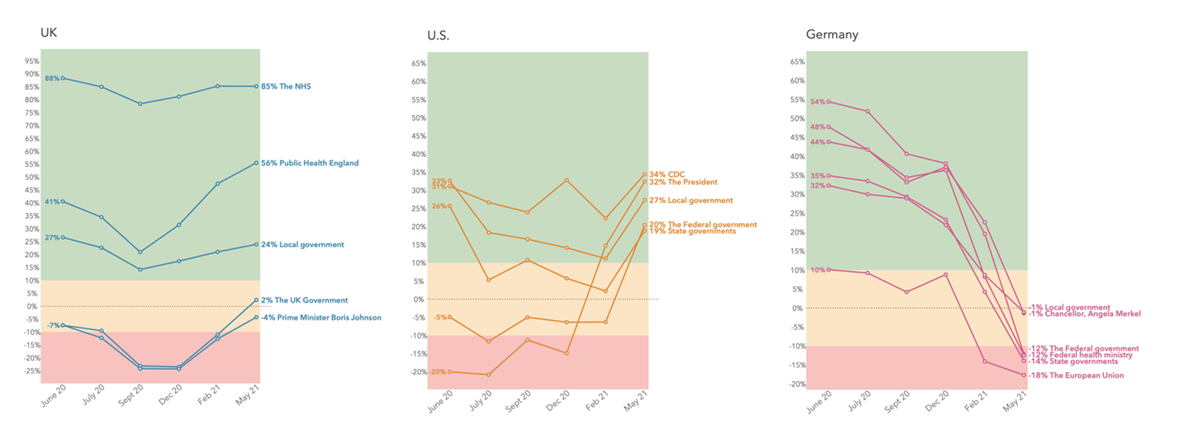

The government and public institutions are benefitting from the success of the vaccine rollout. In the two markets where the public feels that the vaccine programme is going well and where there is optimism for the economic future, the UK and U.S., the public’s ratings for political leaders and public health authorities has risen significantly. For the first time since Kekst CNC began tracking public opinion in April 2020, more people believe that the Government is doing well than badly in responding to COVID-19 with a plus 2% score compared to -11% in February. Boris Johnson has also seen a significant improvement in ranking from -13% to -4% over the same period.

This compares starkly to the picture in Germany, where public confidence in institutions has plummeted, with Angela Merkel falling into net negative territory for the first time (with a score of -1%, previously +23 in February and +48 in June last year), and Emmanuel Macron falling to his lowest score since tracking began last year (-24).

Chart 2: Net % of people saying a given institution has handled the pandemic well in the UK, U.S., and Germany

Business has maintained its significantly positive reputation with online retailers (net 83% positive), food/essential retailers (81% net positive) and the pharmaceutical industry (net 78% positive) all maintaining the positive position seen in February.

Despite the vaccine success, the UK scorecard is a mixed one with two clear and opposing views apparent. While 88% rate the vaccine roll-out as good, only 20% express a positive view on Test & Trace and while 74% believe that healthcare for COVID patients has been good, only 24% would say the same about healthcare for other illnesses.

Employees want flexibility when they return to the office. When looking at their ideal mix in 12 months’ time, 29% of those in work in the UK would choose to work for five days in a week in the office with almost half (49%) wanting flexibility to work in the office and at home, with a three office, two home (19%) mix the most popular choice. 13% would prefer only homeworking, and overall, there is more appetite to be in the office than not, with six in ten choosing an option which involves more time at the office.

James Johnson, Senior Adviser at Kekst CNC, said:

"This research shows that when it comes to recent government successes with the public, the vaccine rollout is key. It has been a critical factor behind the increase in confidence in the Government and in how consumers view the future of the economy. This is completely different to that seen in Europe where dissatisfaction with the vaccine programmes have led to plunging ratings for political leaders – and the lowest ever ratings for Merkel and Macron.

No one is immune from the impacts of the rollout in terms of reputation. In countries where people feel the rollout has gone well, business reputation is improving too. But where it has gone badly, confidence in industry has been dented compared to earlier this year. The lesson of this crisis – for business and for government – that clear evidence of competence can not only boost reputation, but also make up for past mistakes."

Other findings include:

-

Vaccine passports for certain jobs have significant support with the majority in the UK feeling comfortable that doctors and nurses (net 63% comfortable), airline workers (net 55% comfortable), teachers (53%) and public transport workers (52%) should have to show certification for vaccinations. The figures for the UK are higher than for any other country.

-

Business travel is on the agenda and although pre-flight checks are to be expected, delays upon return are not. Across the six countries surveyed, though few plan holidays abroad this year, 51% of regular business travellers plan a business trip abroad in 2021. Across general consumers in the UK, people say that it will be reasonable (by a margin of 65%) say that it will be reasonable to arrive at the airport earlier for flights and a net 59% are also happy to take a test before going abroad and two upon return. Though people are relaxed about a one-hour delay (net 35%), anything beyond this is not seen as reasonable with a net 23% saying that a three-hour delay is not acceptable.

-

An overwhelming majority of British people say that COVID restrictions are about right at the moment. Two-thirds say that COVID restrictions are at about the right level, while one in five (21%) say they are too soft. Only one in ten (11%) say they are too hard.

Methodology and full results

- Nationally representative sample of 1,000 adults in Great Britain, 1,000 adults in Sweden, 1,000 adults in Germany, 1,000 adults in United States, 1,000 adults in Japan and 1,000 adults in France.

- UK fieldwork took place on 22nd-30th April 2021.

- Quotas and weights on gender, age, and region in each country.

- Margins of error of +/- 3.3% for all countries.

- Full results and data tables available at https://www.kekstcnc.com/insights/covid-19-opinion-tracker-edition-8

Media contact

James Johnson

+44 7826 714 286

[email protected]

Joe Shipley

+44 7780 766 857

[email protected]