Kekst CNC survey shows support for government intervention and responsible corporate behaviour

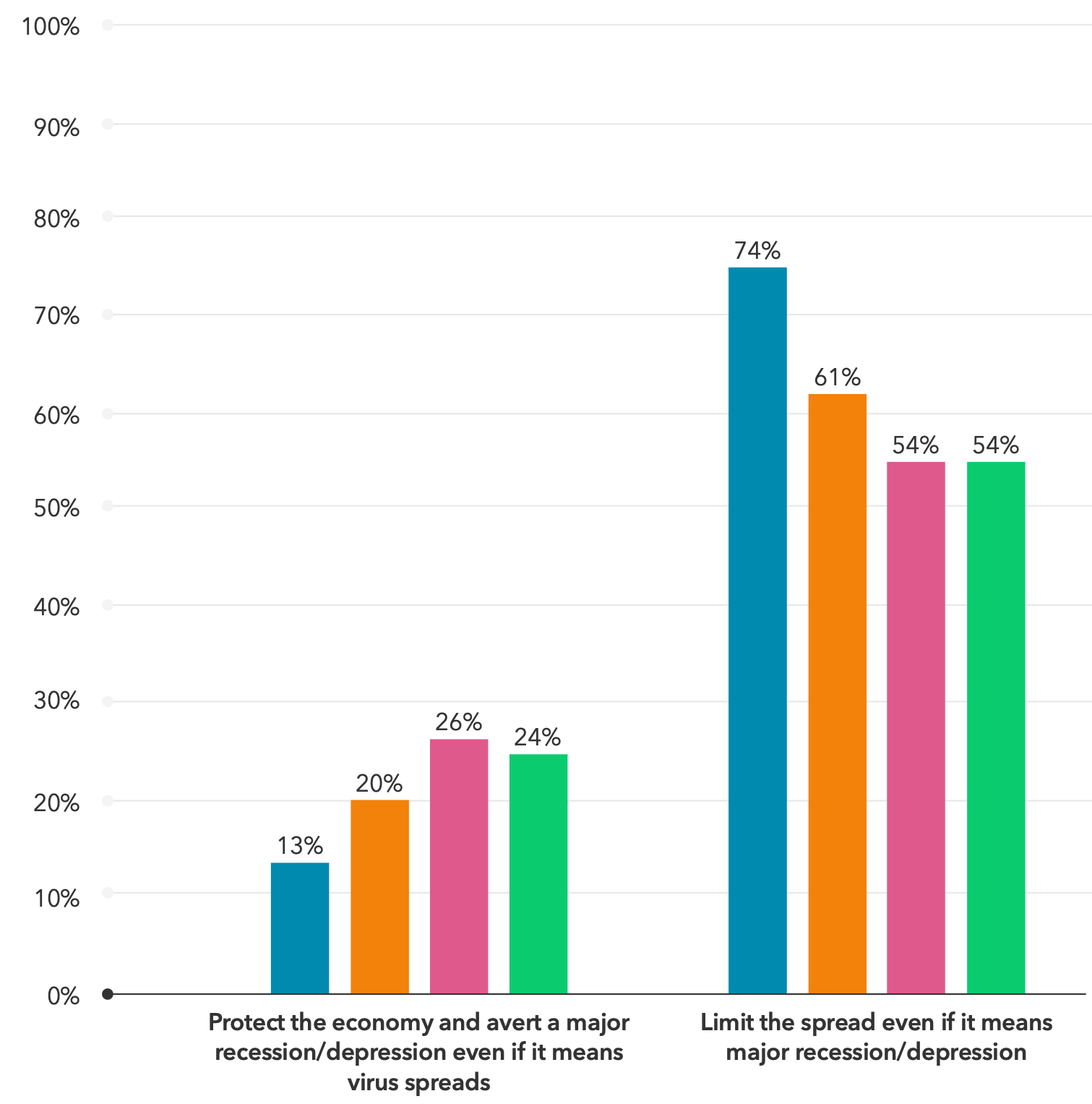

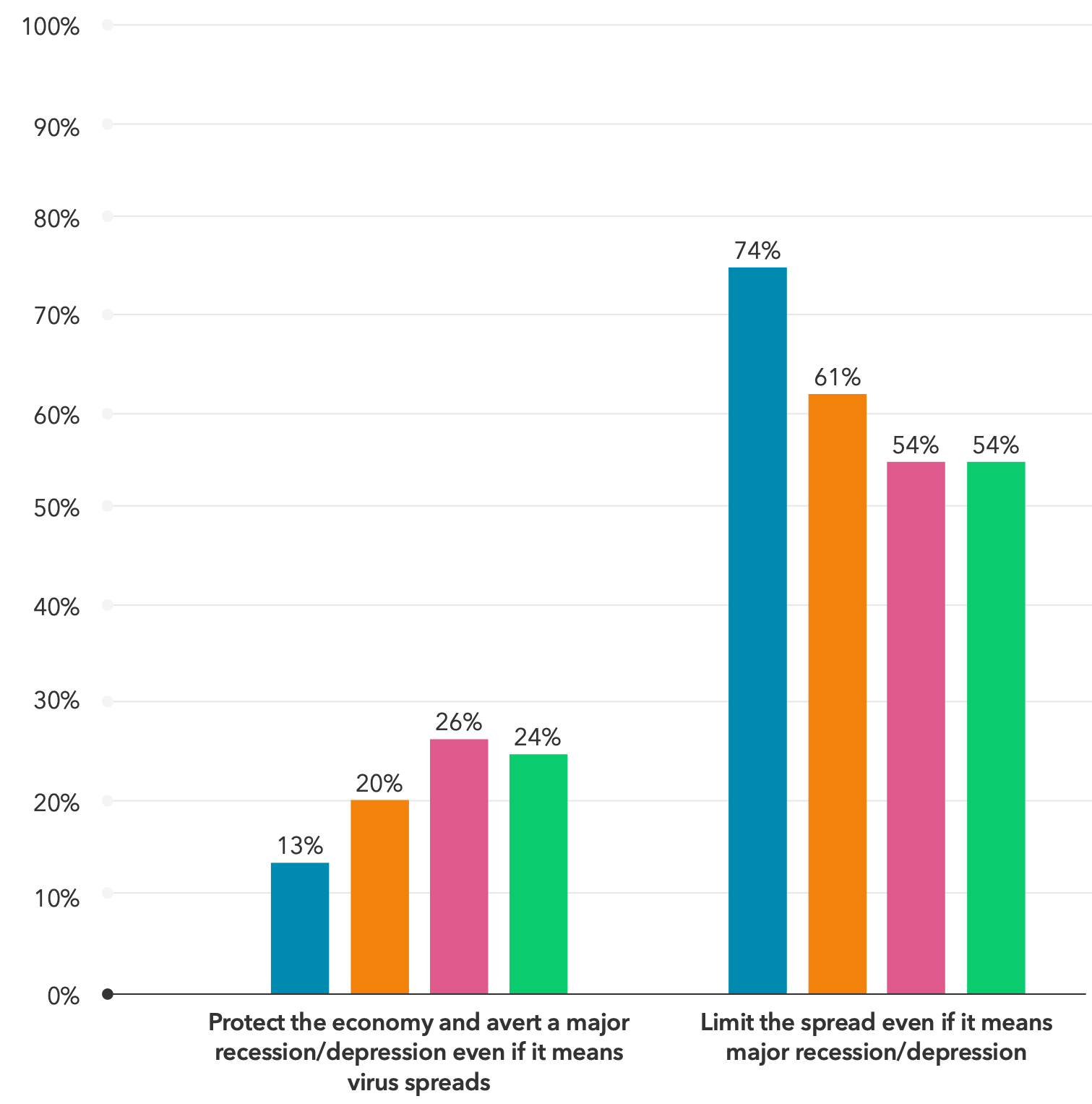

LONDON, 14 April 2020 – The first Kekst CNC COVID-19 international tracking survey has shown that the UK public holds the strongest views - compared to the United States, Germany or Sweden - that the government should limit the spread of coronavirus and save lives, even if that means a major recession or depression and the loss of many jobs. Asked what the government should prioritise, 74% said limiting the spread, and only 13% protecting the economy.

Graph: Percentage of British, American, German and Swedish public who said government should limit the spread vs protect the economy

Furthermore, the UK is the country that most supports state intervention in the economy during the crisis at 82%, with half of the public (51%) feeling that the Government should bail out any company that is in trouble.

The research, carried out among a representative sample of 4,000 adults, including 1000 in the UK, between 30 March and 3 April found that the UK is also far more pessimistic about the long-term impact of COVID-19 than other countries, with more than half of adults believing that the impact on the economy, businesses and the country overall will last for more than a year.

In all cases this is more than double the equivalent figures for the United States and easily the highest of the countries surveyed.

“These results show that a country, seen until recently as divided, is now united. The impact of COVID-19 is seen to be long-term and the British public want our institutions and our companies to stand up and be counted.

The UK supports further Government intervention in significant numbers, recognises the efforts that some companies and institutions are making and will reward those who are supporting the national effort.

For companies who are seen to have acted without care for others, the impact could be severe and long-lasting.”

Responsible Corporate Behaviour

- 80% of UK adults say that they will give their custom to a business that they think has acted responsibly during the crisis rather than to one that has not. The majority of the UK public however (68%) does believe that businesses are stepping up during the coronavirus outbreak. Both of these proportions are the highest for any of the countries surveyed.

Public confidence in business and government

- There is clear support for the UK government’s handling of the crisis (net positive 19%).

- In addition, the actions over the past two weeks of the NHS (44% net positive), the healthcare industry more generally (38%), essential retailers (35%) and manufacturing industry (26%) have increased public confidence in their ability to respond quickly to the crisis.

- The research also found that The old right/left divide on the role of government is suspended – 89% of Conservative voters are comfortable with a bigger role for government, as are 81% of Labour voters.

The Workplace

Regarding the workplace, there is concern about jobs despite good employee communications:

- Some 7% of those surveyed said that they had lost their job and a further 15% think that they might, with 29% worrying that the company they work for might collapse.

- Encouragingly, more than two in three of those in full or part-time work (69%) has received regular communication from their employer and 61% said that they trusted their boss to keep them up to date on how coronavirus would impact their job.

- And as people shift to new working patterns, one in five British workers say they do not know how to carry on doing their job, and 41% of people working at home say their productivity has gone down.

The Future

- The survey also looked towards the future. Currently the UK public expects life to be very different, with potentially significant impacts on various sectors of the economy.

- People expect to travel abroad less than they did before COVID-19 (net 24% less), fly less (23%), go to concerts and exhibitions less (19%) and say they are less likely to use gyms, go to the cinema or eat out. They do, however, expect to be outdoors more and to travel in the UK once the outbreak is over.

- Although working from home has become the norm for many, this is not expected to last. Only a net 4% more people expect to be working from home more after the crisis.

The UK in context

- Swedes are significantly less likely to be very concerned about the impact of COVID-19 on their health (37% compared to 55% in the UK) or the economy (65% compared to 77% in the UK).

- The US public is most concerned about losing their job (54% compared to 41% in the UK) or the effect of COVID-19 on household finances (57% compared to 46% in the UK).

- While opinions of the activities of financial services companies are on balance just positive in the UK (+4%) and United States (+8%) they are negative in Germany (-7%) and Sweden (-16%). The United States is the only market where on balance, central government has disappointed with a net decline in public confidence of 6%.

- The United States has seen by far the highest number of COVID-19 job losses (19%) and has the highest proportion of people expecting to lose their jobs (23%).

- Productivity among homeworkers has gone down everywhere but US employees are those most likely to say they have not had enough support (33% compared to 18% in the UK).

- Germans are most likely to say that the Government should bail-out companies that are in trouble (76% compared to 51% in the UK).

- The United States is where post-crisis behaviour is most likely to be different, with bigger numbers saying they will avoid largescale public events (net 31% less), travel abroad less (net 28% less), and eat out at restaurants less frequently (net 20% less).

Methodology and full results

- Nationally representative sample of 1,000 adults in Great Britain, 1,000 adults in Sweden, 1,000 adults in Germany, and 1,000 adults in United States.

- Fieldwork took place on 30th March – 3rd April 2020.

- Quotas and weights on gender, age, and region in each country.

- Margins of error of +/- 3.3% for all countries.

- Full results of the survey available at: https://www.kekstcnc.com/insights/covid-19-opinion-tracker-edition-1